EQS-News

105

105

0 Kommentare

0 Kommentare

RENK Group AG starts into the new fiscal year with strong revenue growth – guidance confirmed

- RENK Group AG reports strong revenue growth in Q1 2024

- Revenue increased by 22.5% to €238 million

- Order backlog remains high at €4.7 billion, guidance for 2024 confirmed

|

EQS-News: RENK Group AG / Key word(s): Quarter Results Q1 2024 results: RENK Group AG starts into the new fiscal year with strong revenue growth – guidance confirmed |

- Strong revenue growth driven by defense and aftermarket-related business: € 238 million (Q1 2023: € 194 million)

- Order intake at € 208 million (Q1 2023: € 458 million),

USD 100 million contract awarded by the US Army in April - Total order backlog remaining at high level: € 4.7 billion (Q4 2023: € 4.6 billion)

- Adjusted EBIT: € 28 million (Q1 2023: € 19 million)

- Guidance for 2024 confirmed (€ 1.0 - 1.1 billion revenue,

€ 160 million - € 190 million adjusted EBIT, 16 - 18% adjusted EBIT margin)

Augsburg, May 15, 2024 – RENK Group AG, a leading provider of drive solutions for the military and civilian sectors, had a successful start to fiscal year 2024. Compared to the same period in the previous year, first-quarter revenue increased 22.5% to € 238 million (Q1 2023: € 194 million). Order intake tallied € 208 million (Q1 2023: € 458 million) and with adjustment for the two large order wins in the previous year's first quarter it remains strong in the year over year comparison. At the end of March, total order backlog figured at € 4.7 billion (Q4 2023: € 4.6 billion). Adjusted EBIT grew 45.6% to € 28 million (Q1 2023: € 19 million). The sustained high demand for product solutions geared to the military sector as well as aftermarket-related business were definitive for the positive business development of RENK Group AG in the first quarter.

"The geopolitical situation is tense and has become more so over recent months", commented Susanne Wiegand, CEO of RENK Group AG. "The demand for RENK technologies to help safeguard and strengthen the defense capabilities of Germany and its allies remains high."

Growth in all business segments– strong defense and aftermarket-related business

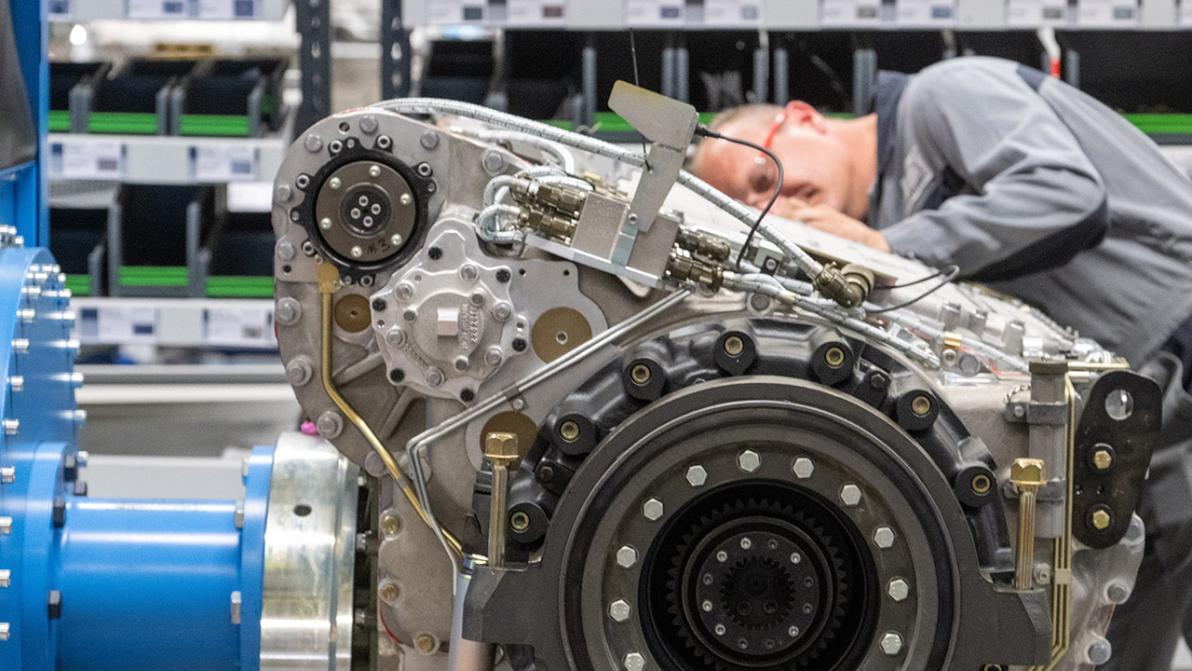

The Vehicle Mobility Solutions segment posted 22.0% revenue growth (Q1 2023: € 110 million). Factoring into this growth is the continuous expansion of the Augsburg plant's production level over the first three months of the current fiscal year. The measures aimed at scaling and further developing production in Augsburg introduced in recent years are taking effect. Adjusted EBIT increased to € 20 million (+15.3% compared to Q1 2023). Order intake was € 79 million, figuring down vis-à-vis the previous year's high (Q1 2023: € 334 million). Two large-order wins had contributed to the outstanding figure for the 2023 first-quarter posting.