Renascor Resources / AUS zukünftig größter Graphit Player

eröffnet am 28.01.18 15:01:19 von

neuester Beitrag 30.05.24 19:00:38 von

neuester Beitrag 30.05.24 19:00:38 von

Beiträge: 3.407

ID: 1.272.702

ID: 1.272.702

Aufrufe heute: 2

Gesamt: 222.676

Gesamt: 222.676

Aktive User: 0

ISIN: AU000000RNU8 · WKN: A1C9A9 · Symbol: RU8

0,0686

EUR

+0,88 %

+0,0006 EUR

Letzter Kurs 31.05.24 Tradegate

Meistbewertete Beiträge

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 28.05.24 | ||

| 30.05.24 |

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 20.05.24 | ||

| 15.05.24 | ||

| 15.05.24 | ||

| 15.05.24 | ||

| 16.05.24 |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 74,01 | +99.999,00 | |

| 1,0000 | +53,85 | |

| 1.056,00 | +17,69 | |

| 794,35 | +12,21 | |

| 8,9700 | +10,88 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 25,56 | -7,96 | |

| 0,8000 | -8,05 | |

| 2,3900 | -8,08 | |

| 0,6300 | -16,56 | |

| 46,92 | -98,01 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 75.866.006 von ma_ko am 30.05.24 16:45:01Hallo Ma_ko

Hänge seit 14 Jahren in na Minengsellschaft fest was so nie geplant aber "Langfristinvestment" ist dann gar kein Ausdruck bin fast verheiratet mit der Firma kenne jede Schraube.

kenne jede Schraube.

Hänge seit 14 Jahren in na Minengsellschaft fest was so nie geplant aber "Langfristinvestment" ist dann gar kein Ausdruck bin fast verheiratet mit der Firma

kenne jede Schraube.

kenne jede Schraube.

Antwort auf Beitrag Nr.: 75.866.006 von ma_ko am 30.05.24 16:45:01....jap! Und, nicht zu vergessen: wenn irgendwann mal die Produktion startet, hat RNU einen Wettbewerbsvorteil durch die vertikale Lage der Garfitader (max 12m u.M) und der super Infrastrukur mit 2 Häfen vor der Türe und kurzen Transportwegen Das war für mich damals einer der Hauptgründe, hier einzusteigen.

Einzig "irgendwann" und "damals" stören. Ich hoffe, es bleibt nur dabei!.

Einzig "irgendwann" und "damals" stören. Ich hoffe, es bleibt nur dabei!.

Antwort auf Beitrag Nr.: 75.864.122 von Pennystockchampion am 30.05.24 12:03:09RNU ist im Moment „schwere Kost“ für die meisten Investierten - es ist ein Langzeitinvestment welches einem seeeeehr viel Geduld abverlangt. Bei solchen Kursentwicklungen versuche ich immer das positive zu sehen, speziell das a) die Regierung hinter dem Projekt steht und b) dass das Unternehmen finanziell gut aufgestellt ist und man sich nicht von einer Kapitalerhöhung zur nächsten hangeln muss wie manch andere Explorer. Das hilft meinem Gemüt dann wieder etwas, zumindest bis zum nächsten Handelstag 😂🤣😂

So ist es leider , gestiegen um dann langsam wieder zu bröckeln

8 % minus heute in Australien.👺

Seit den 30 % plus step by step wieder nach unten.

Denke viele werden langsam ungeduldig...

Ich auch.

Seit den 30 % plus step by step wieder nach unten.

Denke viele werden langsam ungeduldig...

Ich auch.

Antwort auf Beitrag Nr.: 75.849.701 von Pennystockchampion am 28.05.24 09:22:45

Danke auch für deinen schweißtreibenden Einsatz!😉

Zitat von Pennystockchampion: Danke für Deine Arbeit! Hört sich schon mal gut an für mich.

Ich flieg jetzt bald selbst rüber und mach den ersten Spatenstich

Danke auch für deinen schweißtreibenden Einsatz!😉

Antwort auf Beitrag Nr.: 75.849.245 von Maultasch3 am 28.05.24 08:28:44Danke für Deine Arbeit! Hört sich schon mal gut an für mich.

Ich flieg jetzt bald selbst rüber und mach den ersten Spatenstich

Ich flieg jetzt bald selbst rüber und mach den ersten Spatenstich

Habe dann nochmals nachgehakt, weil ich diesen Satz "We identified this as one of the most critical paths to production" richtig verstanden wissen wollte.

Hierzu dann seine Antwort:

"Hi XXXX,

Whilst we are depending on the utility to do the work, I don’t think there is a material risk of delays here, as the scope of work in relatively limited. They are simply upgrading existing capital equipment and transmission lines. This will likely be done long before we need any power."

Hierzu dann seine Antwort:

"Hi XXXX,

Whilst we are depending on the utility to do the work, I don’t think there is a material risk of delays here, as the scope of work in relatively limited. They are simply upgrading existing capital equipment and transmission lines. This will likely be done long before we need any power."

Moin zusamen,

mich beschäftigt schon länger die Frage, wieweit der Fortschritt der Arbeiten von SA Power ist. Deren Aufgabe ist ein wesentlicher Bestandteil des Projekts und nicht über RNU gesteuert. Verzögerungen diesbezüglich übertragen sich auf den Gesamtablauf. 1:1!!

Bislang kam dazu kein Statement mehr. Daher gestern die Frage an D.C. was es damit auf sich hat.

Hier seine prompte Antwort. Möge ein/e jede/r selbst urteilen:

"Hi XXXXX,

Thanks for your email.

The power connection work has commenced. We will have a market update on progress in due course.

We identified this as one of the most critical paths to production, largely because the public utility needs to undertake these capital works. The agreement with SA Power means that, subject to SA Power completing their works as per the contract, this will not delay us.

I hope this answers your questions. If you have any further queries, please let me know.

Kind regards,

David

mich beschäftigt schon länger die Frage, wieweit der Fortschritt der Arbeiten von SA Power ist. Deren Aufgabe ist ein wesentlicher Bestandteil des Projekts und nicht über RNU gesteuert. Verzögerungen diesbezüglich übertragen sich auf den Gesamtablauf. 1:1!!

Bislang kam dazu kein Statement mehr. Daher gestern die Frage an D.C. was es damit auf sich hat.

Hier seine prompte Antwort. Möge ein/e jede/r selbst urteilen:

"Hi XXXXX,

Thanks for your email.

The power connection work has commenced. We will have a market update on progress in due course.

We identified this as one of the most critical paths to production, largely because the public utility needs to undertake these capital works. The agreement with SA Power means that, subject to SA Power completing their works as per the contract, this will not delay us.

I hope this answers your questions. If you have any further queries, please let me know.

Kind regards,

David

Frohe Pfingsten Ihr lieben .....

wir schreiben häufig über Graphit & RNU, aber was hat Australien versus rest der Welt " als "Global Energy transformerquelle"?

Fuelling The Global Energy Transition

As the world shifts towards renewable energy sources to meet Net-Zero targets in the fight against climate change, Australia's role in the global market becomes increasingly pivotal due to its vast reserves of key battery minerals.

Many of the minerals found in abundance in Australia’s earth are essential for battery production, which powers everything from electric vehicles to renewable energy storage solutions.

✨ If we keep tracking down the path set to meet 2050 emissions targets, we could expect the demand for these minerals to climb, underscoring Australia’s importance as a key supplier in the global supply chain for green technologies.

This would create opportunities for investors, foreign or domestic, to capitalize on the nation’s wealth of resources.

Australia holds a dominant position in the market for the three main battery metals:

🔋 Australia is the world’s largest supplier of lithium , producing some 46.9% of the world’s total supply.

Although Chile has larger known reserves, issues with legislation, water scarcity and indigenous groups have prevented expansion to the levels of production we see in Australia.

? Australia is the 5th largest nickel producer globally , accounting for roughly 6% of the global supply.

There is even scope for greater levels of production, considering Australia’s reserves are the second most expansive in the world at 20.6% of the global reserve.

⚡ Australia is the 3rd largest producer of cobalt at 3.5% of the global supply.

Although Australia lags significantly behind the Democratic Republic of the Congo in first, ethical concerns over the use of child labour in artisanal mines could see demand shift to countries with far greater worker protections.

Quote of the Week : "Don't worry about the world coming to an end today. It is already tomorrow in Australia." - Charles M. Schulz

You might have seen a few of our market deep dives of some interesting markets across the globe.

Our insight articles on India and Mexico shone a light on two emerging markets that are well-positioned to benefit from global trends unfolding.

Today, we’ll be looking at the place that we at Simply Wall St call home, Australia !

For a country that is often seen as overrepresented in a lot of things - sport mainly - Australia has quite a subdued presence on the equity market stage. In terms of global equity markets, Australia is merely a drop in the ocean, coming in at only 1.5% of global market share .

But this doesn’t tell the full story of how interesting and unique the Australian economy is. So let’s dive in and begin unravelling what makes Australia’s market tick, what the risks are, and the global trends that Australia is benefitting from.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🇺🇸 US Imposes New Tariffs on Chinese Imports ( Reuters )

Our take: The new tariffs on EVs, batteries, solar panels, semiconductors and numerous other products are as high as 100%. The usual take on tariffs is that they are ultimately paid for by consumers. In this case, it's actually the Chinese government that is paying by subsidizing exporters.

A 100% tariff might sound steep, but some analysts point out that it's not high enough to offset the effect of subsidies. We will now see how much China is prepared to spend (and can afford to spend) to keep its exports going.

💰 Investors pull billions from thematic ETFs ( Bloomberg )

Our take: Bloomberg’s reporting mirrors an article from Ark Invest on flows in Europe. ETFs that invest in clean energy, cybersecurity, EVs, digitization and infrastructure are all seeing large outflows. These themes were all popular 12 to 24 months ago, but have fallen out of favor. On the other hand, cash is predictably flowing to AI, robotics and automation ETFs.

This is a very familiar pattern with thematic funds: money flows in after a strong rally and out after the inevitable decline. This is another reminder to be careful investing in themes when they are ‘in fashion’.

🇨🇳 China issues US $138 billion in bonds to support the economy ( FT )

Our take: These bonds were largely expected by the market, but investors weren’t sure on the details. They will have durations of 20-50 years and they began issuance in May 17th. The funds will likely be used to support the economy in areas where it’s struggling (real estate, etc) and boost domestic demand by helping consumer confidence. Chinese officials have said the bonds will: “ support the implementation of major national strategies as well as building security capabilities in key areas ”. So, interpret that as you will.

🇺🇸 US Inflation data was better than feared ( Reuters )

Our Take: Investors were stoked to hear that inflation printed lower than expected (3.4% vs 3.5% expectations), so the market rallied on the news. The latest inflation print boosted investors’ hopes that The Federal Reserve might start its easing cycle this year. Considering the market has already rallied for the last 6 months largely on the idea of rate cuts this year, and they keep getting pushed further out, investors might need to adjust their expectations which could push the market lower.

🇦🇺 The Land Of Abundance

No discussion about Australia’s economy could be had without mentioning Australia’s resources sector. Australia’s resources are not just a cornerstone of the nation’s economy; they also play a significant role in global infrastructure.

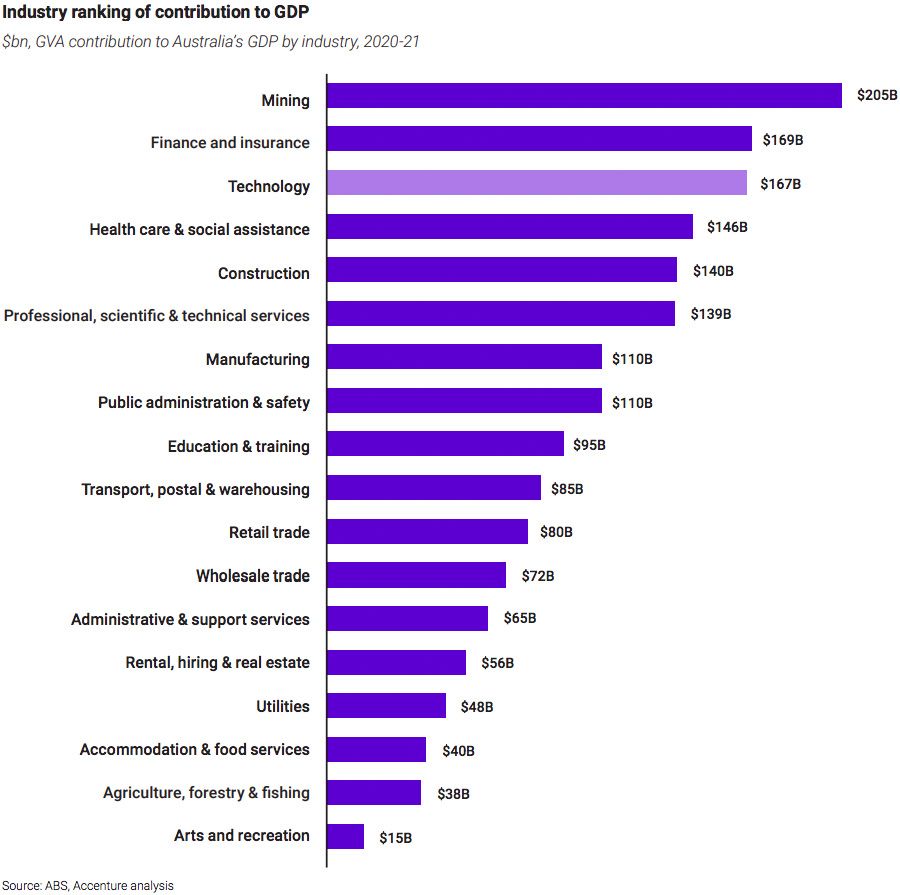

The mining and resource sector directly contributes approximately 14.3% to the nation’s GDP , the largest contribution, ahead of the Health & Education sectors at 12.8% and the Financial Services sector at 7.4%. The mining and resource operations are heavily concentrated in regions rich in natural resources, such as Western Australia and Queensland.

The country ranks as the world’s leading exporter of key commodities like iron ore - of which Australia accounts for 55.4% of global supply - and coal . Australia is also increasing exports of important rare earth elements and other minerals critical for modern technologies.

🔋 Fuelling The Global Energy Transition

As the world shifts towards renewable energy sources to meet Net-Zero targets in the fight against climate change, Australia's role in the global market becomes increasingly pivotal due to its vast reserves of key battery minerals.

Many of the minerals found in abundance in Australia’s earth are essential for battery production, which powers everything from electric vehicles to renewable energy storage solutions.

✨ If we keep tracking down the path set to meet 2050 emissions targets, we could expect the demand for these minerals to climb, underscoring Australia’s importance as a key supplier in the global supply chain for green technologies.

This would create opportunities for investors, foreign or domestic, to capitalize on the nation’s wealth of resources.

Australia holds a dominant position in the market for the three main battery metals:

✨ Australia could be an opportunity for global investors seeking exposure to resources like iron ore or battery metals, particularly as ESG concerns and sovereign risks may deter investment in other resource-rich regions like Africa or South America.

Uranium: Is Australia About To Have A Glow Up?

It’s not just battery metals that Australia has an abundance of; Australia also holds expansive reserves of natural gas and uranium. As touched on last week, the rising uranium price has piqued the interest of investors in Australia’s market.

Australia’s uranium reserves are the largest in the world, hosting as much as one-third of the world’s known uranium resources . However, Australia is only the fourth-largest producer of uranium.

Decades of aversion to mining uranium embroiled with post-Cold War fear has meant that Australia’s uranium mining industry is somewhat underdeveloped.

Australia’s export of uranium is limited to countries with whic h Australia has formed a bilateral nuclear cooperation agreement with; and the exports must explicitly be for peaceful non-explosive purposes.

However, the requirement for these agreements doesn’t seem to limit Australia’s export capacity, with agreements already struck with countries with significant nuclear arsenals like Russia, China, France and the United States. Enforcing that law might be a bit hard.

In addition, Japan - Australia’s second-largest trade partner - added uranium to its critical minerals list . While it’s not clear if Australia will dramatically increase its production of uranium to meet the rising demand, this is an indication that the opportunity is there for investment, since demand is rising.

✨ Globally, t he uranium tide seems to be turning in recent years. The UN Climate Change Council declared a need to triple global nuclear capacity to meet 2050 Net-Zero targets. So if the narrative globally continues to become more favourable to nuclear power, then the industry might enjoy more favourable political and societal conditions.

This all sounds great, but what’s the catch? 🌏 Is Australia Really An Investor’s Paradise?

It does have a vast supply of critical mineral reserves, the magnitude and breadth of which are unrivalled globally. It has a largely stable and cooperative weather climate which lends itself to consistent project operation in the area, which not all resource countries can claim. Plus, it has a relatively stable political landscape with a legal framework familiar to investors in the United States and the United Kingdom.

So what’s the catch?

Well, like any country, there is always some level of sovereign risk, so let's take a look at some of the risks investors should be aware of.

⚠️🤝 The Risk Of Relying On One Big Trade Partner

Australia's economic landscape is significantly influenced by its trade relationship with China, its largest trading partner.

In the 2022-23 fiscal year, two-way trade with China totalled AU$316.9 billion, with Australia’s goods and services exports to China encompassing almost two-thirds of that total! (AU$203.5 billion).

Iron ore is far and away the largest export with China importing AU$104.8 billion worth, followed by natural gas with exports totalling AU$20.8 billion, closely followed by crude minerals at AU$19.8 billion.

While having such an expansive trade relationship is important, providing support to Australia’s mining sector, as well as other key segments like agriculture, and education, it does highlight a significant risk.

Australia’s Exports by Country - Trading Economics

✨ The reliance on Chinese demand could upend Australia’s entire economy if the stability of the trade relationship was jeopardized.

Be it from political tensions or simply macroeconomic turmoil, a significant decline in demand for Australian exports from China could spell disaster if these industries are unable to redirect supply to other foreign trade partners.

While the relationship between China and Australia is currently ‘fair’, there have been moments recently where the relationship has been tested.

😬 A Not So Rosy Relationship....Australien versus CHINA is eine hervoraggende Ausgangslage für RNU, Latrobe & co, auf der suche nach verlässliche Lieferanten & partner der Zukunft...der westliche Produktionswelt braucht neuen Rohstoffpartnern mit jeder neu geschlossene Embargo gegen China, Iran Russland & Co ☕

Despite the economic benefits, the relationship between Australia and China has been fraught with strategic and diplomatic tensions over recent years.

The issues range from cybersecurity concerns to trade tariffs and restrictions.

On the cyber front, the Australian Signals Directorate had pointed the finger at China over a spate of malicious attacks on Australian companies and infrastructure.

As for trade tariffs, following the pandemic, China placed a number of tariffs on Australian exports like wine, where tariffs were raised to 200% , and barley. Further biosecurity restrictions impacted Australia’s agricultural sector with several beef abottoirs sanctioned and timber exports blocked, in addition to bans on the export of coal, cotton and lobsters .

As a result of these trade restrictions, Australia’s exports of certain goods to China fell to nearly zero. The impact of the restrictions was economically significant, as Australia’s exports to China fell from 33% of Australia’s total export market to 27.6% in 2022.

...if the trend is truly our friend, na denn "down under" is on the "up" meiner bescheidenen Meinung nach

😎

😎

Renascor Resources / AUS zukünftig größter Graphit Player